You should incorporate a GL into your business practices if you want up-to-date financial reports to secure small business loans, balance your books effectively, prepare for an audit, or accurately file your taxes. The best way to know if your general ledger is correct is to reconcile all entries then generate a trial balance to verify the completeness and ensure that debit balances equal credit balances. The GL is a big part of your company’s overall financial picture, acting as an important repository of all your accounting data. It is the place where accountants can easily access a streamlined picture of the business income and expenses. Having an accurate record of all transactions that have taken place within a single point in time will ensure your financial reporting is done correctly.

General Ledgers: What Are They and Why They’re Important

It chronologically and systematically captures these transactions, ensuring none slip through the cracks. By documenting every monetary move, the GL provides the raw data that becomes the bedrock for subsequent accounting analyses and reports. Analyzing account balances aids stakeholders in gauging the financial health, liquidity, and performance of an organization. For instance, a dwindling general ledger accounting cash account balance might signal potential liquidity issues, while steadily increasing revenue account balances could indicate robust business growth. Your general ledger might break these down into accounts for rent, merchant fees, software subscriptions, telephone and internet, cleaning, and so on. Accounts receivable (AR) refers to money that is owed to a company by its customers.

Would you prefer to work with a financial professional remotely or in-person?

Law firms should first be sure to follow the general ledger best practices applicable to all companies. As outlined above, this means implementing regular account reconciliations and more frequent reviews of the general ledger. The practice of law is sufficiently demanding that it is easy to lose focus on financial matters, but general ledger accounting with sufficient safeguards should allow even the smallest firms to handle this task. The ledger is a book in which all accounts relating to a business enterprise are kept. In other words, it is the collection of all accounts of a business enterprise.

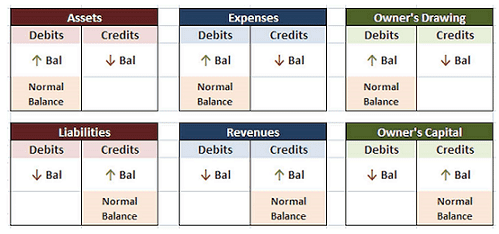

Double-Entry Bookkeeping

Its role transcends mere record-keeping; it’s the linchpin that ensures the financial soundness of an entity. Accounts payable is the money a company owes to its suppliers and vendors for products and services purchased on credit. When a company buys something from a vendor, it typically doesn’t pay for it immediately. Although there are many possible accounts in a general ledger, they can all usually be classified into permanent and temporary categories. Let’s look at some of the accounts small businesses may use in the general ledger.

Accounting 101 for Small Businesses

The ledger’s accuracy is validated by a trial balance, which confirms that the sum of all debit accounts is equal to the sum of all credit accounts. Bookkeeping at small businesses can be accomplished with general ledger software for simple data entry, basic financial reporting, or a desire to add subledgers to their Excel spreadsheets. CPAs and accountants may use general ledger software that was developed for accounting firms for the purpose of creating trial balances. Larger businesses may look to an ERP program that provides a full business management suite, which will include a general ledger accounting module within its financial management section. They provide an updated view of the company’s assets and liabilities, as well as how efficiently it manages cash.

steps to general ledger reconciliation

It serves as a central repository for all the individual accounts, such as cash, accounts receivable, accounts payable, and various expense and revenue accounts. Each account in the general ledger contains a running balance that reflects the cumulative effect of all related transactions. While the general ledger and general journal are both important accounting https://www.bookstime.com/ tools, they serve different purposes. The general journal is where transactions are first recorded, providing a chronological record of all financial activities. Each transaction is documented with details such as the date, description, and amounts involved. This chronological order allows for a clear and accurate representation of the sequence of events.

- Further, these transactions are recorded based on the Duality Principle of Accounting.

- The general ledger is a fundamental tool in accounting that plays a crucial role in organizing and categorizing financial transactions.

- The ledger contains accounts for all items listed in the accounting equation, i.e. assets, liabilities and equity.

- While there might be a learning curve for newcomers, its vast features make it invaluable for companies seeking agile decision-making tools.

- Batches or groups of similar accounts are kept together, and ledgers are indexed so that information pertaining to a particular account can be obtained quickly.

- With the nature of the potential mistakes outlined above, there can be no doubt that reconciliation of accounts is an absolute must.

- For example, a bookkeeper or accountant could use an accounting ledger, or general ledger, to identify the source of increased expenses and make the necessary corrections.

- These are typically reported on the left-hand side of your company’s balance sheet.

- One example is the use of electronic data interchange (EDI), which can help update inventory general ledger records in conjunction with sales order transactions as they occur.

- Are you a small business owner looking to understand general ledger accounting?

- Transaction data is segregated, by type, into accounts for assets, liabilities, owners’ equity, revenues, and expenses.

- When you set up your general ledger, you must decide whether you’ll use the double-entry method or the single-entry method.

- However, reconciling individual account balances becomes extremely easy with online accounting software like QuickBooks.

Most companies prepare a trial balance at the end of each reporting period. A company’s total assets must equal the sum of its liabilities and the owner’s equity in a double-entry system. A double-entry system ensures the balance sheet stays balanced every time and that each debit has a corresponding credit. By preparing a trial balance, you make sure your accounting is correct before creating financial statements for the accounting period in question. The trial balance tallies all your debits and credits for the accounting period and makes sure they match up.

- Therefore, you can further use the accurate amounts showcased in your Trial Balance to prepare the financial statements.

- On January 1, a firm received $10,000 from a debtorDebtorA debtor is a borrower who is liable to pay a certain sum to a credit supplier such as a bank, credit card company or goods supplier.

- For example, the amount payable to United Traders on the first day of the accounting period is recorded on the credit side of the United Traders Account.

- When starting a small business, you may not know all of the important ins and outs of record keeping.

- The double-entry bookkeeping method ensures that the general ledger of a business is always in balance — the way you might maintain your personal checkbook.

- If the totals of the two sides of the account are equal, the balance will be zero.

Have Backup for Important Tax Documents

If you decide to research double-entry bookkeeping, you’ll probably come across the term “trial balance” often. If you choose to set up a double-entry ledger, you should be ready to prepare trial balances regularly. Furthermore, General Ledger Accounting also helps you to spot material misstatements with regard to various accounts.

вошли На Официальный Сайт 1хбет Прямо сейчас По Рабочей Ссылк

вошли На Официальный Сайт 1хбет Прямо сейчас По Рабочей Ссылк